But Difference alone is not enough.

Take two challenger brands in the ready meals category: Gym Kitchen and Cook. Both score high on Difference – Gym Kitchen is emotionally resonant and highly shared amongst fitness tribe and Cook owns a unique premium positioning.

But both fall short on Attraction. They are not widely considered by a mass market and have low levels of brand attachment or preference. This is reflected in their lower market share compared to mainstream giants like Birdseye or Cathedral City.

To grow, these brands need to build Attraction without losing their Difference. That means expanding reach, distribution, and product range, while keeping communications distinctive.

Cook has begun by gaining distribution outside shops in Co-op, campsites and Centre Parcs, could service stations and other transport hubs hold similar potential for those shopping for low prep meals on the way home? The Gym Kitchen may have a bigger positioning problem, but potentially larger protein seeking audience like middle aged women hold potential?

The Takeaway

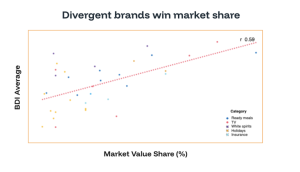

If you want to grow your brand, don’t just ask “Are we different?” Ask “Are we different and attractive?” High-growth brands walk the tightrope of originality and familiarity, and the Divergence Brand Index is your new way to manage that balancing act. It’s not just a score; it is a strategic springboard for action across the full marketing mix.

Curious where your brand sits on the Brand Divergence Map?

We have also mapped the Holidays, Insurance, Consumer Electronics, Building Society and Banking and Spirits categories, and will be mapping more moving forward to build our benchmarks. Drop us a message or get in touch to explore where your brand sits and how you could unlock more value through Difference and Attraction.